From first-time homebuyers to seasoned investors, we make every loan possible — fast, flexible, and built around you.

Explore our wide range of customized loan programs designed to fit your unique financial situation. Whether you're a first-time homebuyer, seasoned investor, or self-employed entrepreneur, we have the right lending solution for you.

Standard Residential Loan Options

FHA Loans

Perfect for first-time buyers with lower down payment requirements (as little as 3.5%) and flexible credit score guidelines.

VA Loans

Exclusive $0 down payment options for veterans, active-duty military, and eligible spouses with competitive interest rates.

Conventional Loans

Standard purchase and refinance options with down payments as low as 3% and favorable terms for borrowers with good credit.

Jumbo Loans

Specialized financing for high-value and luxury properties that exceed conforming loan limits in your area.

Self-Employed & Alternative Documentation Loans

Bank Statement Loans

Qualify based on deposits rather than tax returns, ideal for business owners who maximize deductions. We analyze 12-24 months of bank statements to determine your loan eligibility.

P&L and Stated Income Loans

Simplified qualification using your business's Profit & Loss statements or stated income programs designed for self-employed professionals with complex financial situations.

No Ratio DSCR Loans

Investment property loans that focus on the property's cash flow rather than your personal income, perfect for expanding your real estate portfolio without income verification.

Investor & Business Property Financing

DSCR Loans

Cash-flow based financing that uses the property's rental income to qualify rather than your personal income.

Fix & Flip Loans

Short-term financing for purchasing and renovating properties with flexible terms and quick funding.

Multi-Family Loans

Specialized financing for properties with 2-4 units and larger apartment buildings with competitive rates.

Construction Loans

Ground-up financing for new builds with structured draw schedules and conversion options to permanent financing.

Equity & Second Position Financing

Home Equity Lines of Credit (HELOCs)

Tap into your home's equity without refinancing your first mortgage. HELOCs provide flexible access to funds with interest paid only on the amount you use.

• Revolving credit line against your equity

• Variable interest rates with interest-only payment options

• Typically up to 90% combined loan-to-value

Perfect for renovations, education expenses, or debt consolidation.

Fixed Second Mortgages

Second lien position loans with predictable fixed payments. Ideal when you want a lump sum with stable monthly payments rather than a revolving line of credit.

• Fixed interest rate and payment amount

• Terms typically from 5-30 years

• Lump sum at closing

Bridge Loans

Short-term financing that allows you to purchase a new home before selling your current property. Eliminate contingent offers and gain negotiating power in competitive markets.

• Short terms of 6-12 months

• Based on equity in current home

• Interest-only payments

Specialty Loan Programs

ITIN Loans

Specialized mortgage options for non-U.S. citizens using Individual Taxpayer Identification Numbers instead of Social Security numbers.

Mobile Home Loans

Financing solutions for manufactured homes on either leased land or property you own, with competitive terms.

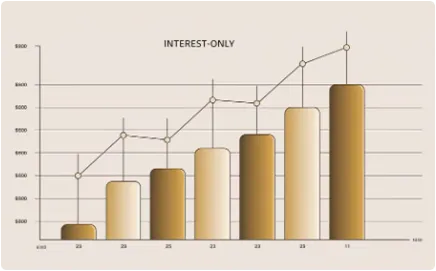

Interest-Only Loans

Lower initial payment options that allow you to pay only interest for a specified period, ideal for properties with appreciation potential.

Reverse Mortgages

Convert home equity into tax-free cash flow for homeowners aged 62 and older, with no monthly mortgage payments required.

Hard Money Loans

When time is tight and traditional financing just won’t work, Groves Capital's Hard Money Loan Programs deliver speed, flexibility, and funding — without the red tape. Built for Flippers, Rehabbers, & Dealmakers

Commercial Loans

Groves Capital offers a full suite of commercial loan programs designed to support entrepreneurs, developers, and real estate investors nationwide. We offer Office, retail, mixed-use, warehouse, and multifamily (5+ units)

Loans Closing in LLC

For real estate investors and business owners, closing a loan in your LLC, S-Corp, or other entity offers protection, privacy, and tax advantages. Groves Capital supports entity-based closings across most of our non-QM.

Foreign National Loan

Buying U.S. real estate without U.S. citizenship? We've got you covered.

At Groves Capital, we offer flexible Foreign National mortgage solutions designed specifically for non-U.S. residents looking to invest in residential or commercial

Contact: [email protected]

Phone: 888-611-0998

4883 Ronson Court, Suite A, San Diego, CA 92111

© 2023 Groves Capital - All rights reserved.