Mortgage Made Effortless. Powered by AI. Backed by Experts.

We simplify lending with intelligent automation and personal support — so you get the loan you need, faster than ever.

Groves Capital Mission Statement

🏡 For Borrowers:

“Empowering Every Path to Homeownership.”

At Groves Capital, our mission is to make every loan possible — from first-time homebuyers to seasoned investors — by leading with positivity, solutions, and speed.

We embrace every borrower’s journey with care, creativity, and cutting-edge technology to deliver fast approvals, real answers, and a 5-star experience for every loan type — no matter how unique

🤝 For Broker Partners:

“Built by Brokers. Backed by Tech. Powered by Trust.”

Groves Capital was founded by brokers, for brokers — because we believe independent mortgage pros deserve more than big-bank tools.

Our mission is to equip you with the solutions, support, and smart automation you need to close faster, scale smarter, and win more deals.

With 160+ lenders, 500+ teammates, and next-gen tools like Groves IQ, we’re not just a platform — we’re your partner.

About Groves Capital

We combine financial expertise with innovative technology to transform the mortgage experience. Our approach bridges the gap between traditional lending relationships and modern digital convenience, ensuring our clients receive both the personal attention and technological advantages they deserve in their home financing journey.

Our Founding

Aleyna & Chris Groves established the company with a vision for mortgage innovation, combining their decades of industry experience to create a more client-centered lending approach. Their partnership began with a shared commitment to transparency and efficiency in an industry often criticized for complexity.

Technology Integration

Pioneered AI-driven solutions to streamline the mortgage process, becoming one of the first lenders to implement voice technology updates and automated application reviews. This innovation reduced approval times by 40% while maintaining rigorous compliance standards.

Expanding Our Reach

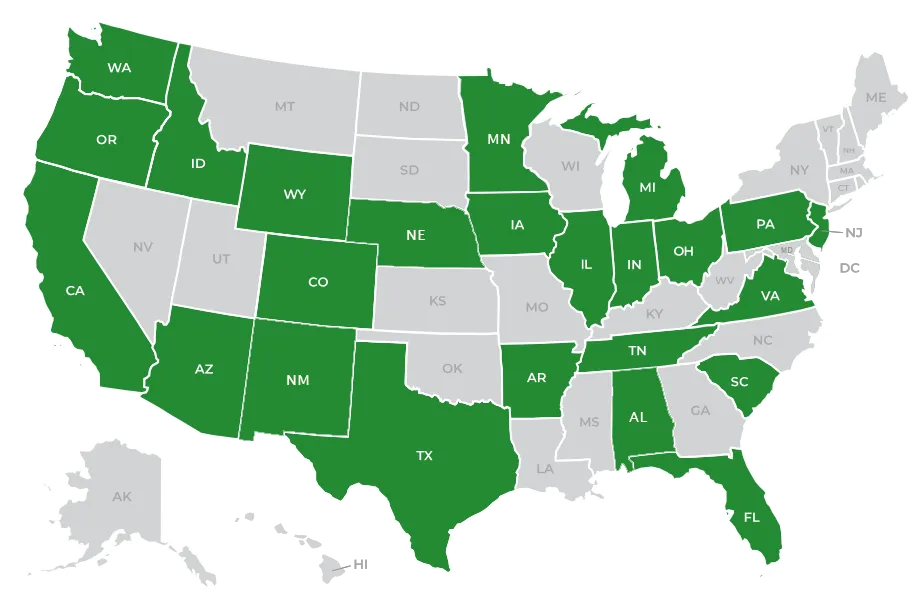

Developed a comprehensive broker network spanning 38 states, creating strategic partnerships that extended our loan solutions to diverse communities and underserved markets. Our broker portal revolutionized how partners access and process loans.

Today's Mission

Delivering personalized financing solutions backed by advanced technology, with a team of over 500 mortgage professionals dedicated to finding the perfect loan program for every client situation. We maintain a 98% customer satisfaction rate through our unique blend of technological efficiency and human expertise.

Apply Now Process | Step by Step

Select Your Purpose

Choose buying or refinancing to start your journey.

Complete Smart Form

Our intelligent application adapts to your specific needs.

AI-Powered Processing

Receive updates and next steps automatically.

Human Expertise

Get personalized guidance from our specialists.

Start your streamlined application process today and experience our unique blend of technology and service.

Contact Us

Schedule a Call

Book a convenient time to speak with our mortgage experts.

Send a Message

Fill out our simple contact form for general inquiries.

24/7 AI Support

Get immediate answers from our intelligent chatbot.

We're here to help with your mortgage questions and needs.

What Makes Us Different

AI-Powered Chatbot

Get instant answers to your mortgage questions any time, day or night.

Voice AI Updates

Receive automated voice updates on your application status and next steps.

Human Expertise

Access experienced mortgage professionals who understand your unique needs.

24/7 Digital Access

Check your application status and upload documents anytime via our secure portal.

Experience the perfect balance of innovative technology and genuine human support.

Client Success Stories

I have financed multiple properties with these guys, and it's been amazing every time. The process was seamless. And I got the best possible rate. They are incredibly professional and efficient. Highly recommended.

Groves Capital is truly the best in the country. Their team is exceptional, providing outstanding service with unmatched professionalism. Highly recommended!

Kristin Howard & Travis Welfle were amazing. They were very responsive and diligent. Kristin walked me through the whole process and made the experience less stressful than I had anticipated. Thank you!

# Our Partners

As Seen In The News

# Work With Us

States We Lend In

Looking for lending in a state not listed? We do lend in other states on a case-by-case scenario. Give us a call to see what we can do for you.

Contact: [email protected]

Phone: 888-611-0998

4883 Ronson Court, Suite A, San Diego, CA 92111

© 2023 Groves Capital - All rights reserved.